bank owned life insurance tax treatment

However distributions and loans are unfavor-ably treated. However if the BOLI policy is transferred for value ie the purchase of an existing policy rather than a newly issued policy the death.

/hsbc-branch-in-new-bond-street--london-533780165-ff99ebc393c243cba463ea80559836b0.jpg)

Bank Owned Life Insurance Boli

Experts tend to agree that one of the main selling points of BOLI is its tax-favored treatment.

. Insurance and Tax Issues Congressional Research Service 1 Introduction Life insurance policies taken out by and payable to companies on their employees directors officers owners and debtors are commonly known as corporate-owned life insurance COLI policies. Unlike traditional bank investments the. What are the tax consequences of surrendering Bank Owned Life Insurance BOLI.

The separate accounts including varioussub-accounts typically consist of. If the tax treatment of Bank Owned Life Insurance BOLI changes existing plans may be grandfathered. In addition most BOLI policies are classified as Modified Endowment Contracts.

The BOLI Policies are invested in the general accounts and separate accounts of the BOLI insurers. What are the tax consequences of surrendering Bank Owned Life Insurance BOLI. This swift expansion is due to the very favorable tax treatment applied to these policies.

The primary benefit of BOLI is its treatment for corporate income tax purposes. Taxpayer maintains a BOLI Program in which it acquires life insurance policies from a variety of life insurance providers on a group of its officer-level employees. The tax benefit of life insurance MetLife ICOLI vs.

BOLI receives favorable accounting and PL treatment relative to taxable. Any gain above the premium that the bank paid would be taxed at the normal rate. In recent years many banks have rapidly increased the percentage of their Tier I capital de-voted to BOLI policies.

1 lifetime distributions are taxed under an income-first-basis-second. It should be noted that BOLIs current tax benefits have been unsuccessfully challenged over the years. Bank Owned Life Insurance BOLI Bank Owned Life Insurance BOLI is defined as a company owned insurance policy on one or more of its key employees that will informally fund the financing of employee benefits programs.

In addition most BOLI policies are classified as Modified Endowment Contracts. Bank-owned life insurance BOLI as a strategy to manage escalating employee benefi ts costs. Advantages of Bank-Owned Life Insurance BOLI BOLI is a tax-efficient tool commonly used by banks to informally finance employee retirement and benefit program liabilities.

Bank Owned Life Insurance and Tax Reform. Bank Owned Life Insurance BOLI is a tax efficient method that offsets employee benefit costs. If a life insurance policy is a MEC it generally receives the same favorable tax treatment as non-MEC life insurance policies including in most situations tax-free cash value buildup and tax-free death proceeds.

It can help banks deliver on benefit promises made to employees and enable them to provide more competitive benefit programs while containing costs. The tax issues associated with key person term life insurance are relatively unambiguous. The premiums can be a sizable capital commitment that might range from 250000 for an individual to upwards of 8 million for a group of 15 bank executives.

The general rule for bank-owned life insurance BOLI is that proceeds received by reason of death are tax free. Income earned on the policies is tax-free for the bank and when an employee dies the cash payments the company receives are tax-free. While any insurance owned by a bank can be referred to as BOLI the term is most often applied to insurance marketing programs in which life insurance is offered to a bank specifically as an opportunity for the bank to take advantage of tax deferred cash value growth.

There are two primary types of BOLI general account and separate account. Although it may sound strange BOLI is a tax. Done properly BOLI may offset the current and future costs of pre- and post-retirement medical coverage group life retirement.

Bank owned life insurance or BOLI is a form of life insurance purchased by banks generally on the lives of their executives and key employees. Taxable investment ICOLI2 Taxable investment5 800 Hypothetical investment and return net of asset management fees and transaction costs 800 085 Less insurance charges3 000 715 Net pre-tax return 800 000 Less 1 assumed taxes 100 portfolio turnover 168 715 Net after-tax return4 632. The buildup of cash surrender value within the policy is included in book earnings but excluded from the calculation of federal taxable income.

If the taxpayer is directly or indirectly a beneficiary under the policy or contract The tax treatment of death benefits. BOLI offers unique advantages over alternatives. But if they are not grandfathered they may be surrendered for their cash surrender values.

The bank purchases and owns an insurance policy on an executives life and is the beneficiary. Cash surrender values grow tax-deferred providing the bank with monthly bookable income. Corporate-Owned Life Insurance COLI.

As an asset on the banks. This general rule changed when Sec. Term Life Insurance.

Bank-Owned Life Insurance BOLI Bank-owned life insurance is a type of life insurance bought by banks as a tax shelter leveraging tax-free savings provisions to fund employee benefits. Any gain above the premium that the bank paid would be taxed at the normal rate. Tax-deferred growth of cash value 1 3 Tax-free receipt of death proceeds 2 3 Tax-free loanswithdrawal to basis 1 4 5 Capital guarantees.

264a1 provides No deduction shall be allowed for premiums on any life insurance policy. In general proceeds from life insurance policies are tax free under the general exception rules in Sec. The new section limits the amount of tax-free treatment a person which can be any type of entity can receive from the proceeds on an.

The new provision could have unintended consequences for bank mergers and. The primary benefit of BOLI is tax-related. The sweeping Tax Cuts and Jobs Act TCJA signed into law in late 2017 includes a provision that appears to apply to bank-owned life insurance BOLI which often is used as a tax-free investment for banks sometimes but not always coupled with an employee benefit program.

101 j 1 was added with the enactment of the Pension Protection Act of 2006 PL. Bank-owned life insurance and imputed income tax reimbursement agreements NOTE 10 BANK-OWNED LIFE INSURANCE AND IMPUTED INCOME TAX REIMBURSEMENT AGREEMENTS The Bank has a significant investment in bank-owned life insurance policies BOLI and provides endorsement split dollar life insurance to certain employees in the position of Vice President. This of course is done within the context of a legitimate business reason.

By far the biggest disadvantage is you pay for the insurance policy up front McCandless says. Upon the executives death tax-free death benefits are paid to the bank.

How To Buy Life Insurance In March 2022 Policygenius

Is Life Insurance Taxable Forbes Advisor

Irs Foreign Life Insurance Policy Taxation Is Income Taxable

/life-insurance-policy-185263144-0b47d104cb7347e3ad79da3c2b5de23c-9445d753496441d9aaad09e446e1142b.jpg)

Stranger Owned Life Insurance Stoli Definition

Key Factors Nris Should Consider Before Buying A Life Insurance Policy

Do Beneficiaries Pay Taxes On Life Insurance

/life_insurance_151909996-5bfc3710c9e77c00519d7859.jpg)

Understanding Taxes On Life Insurance Premiums

:max_bytes(150000):strip_icc()/lifeinsurance-v32-8e01fd19793a49699e47973cfdf98f3d.png)

Life Insurance Guide To Policies And Companies

Lic Ipo 5 10 Discount Will Make It Attractive For Policyholders Ithought Financial S Shyam Sekhar

Taxation Of Annuities Ameriprise Financial

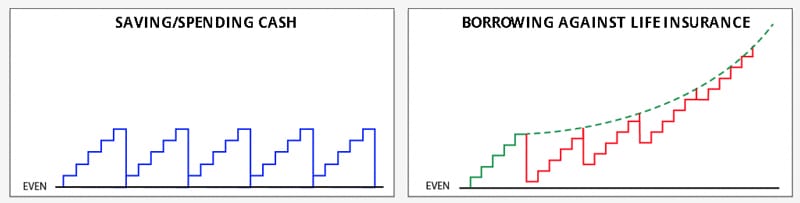

5 Steps To Be Your Own Bank With Whole Life Insurance Banking Truths

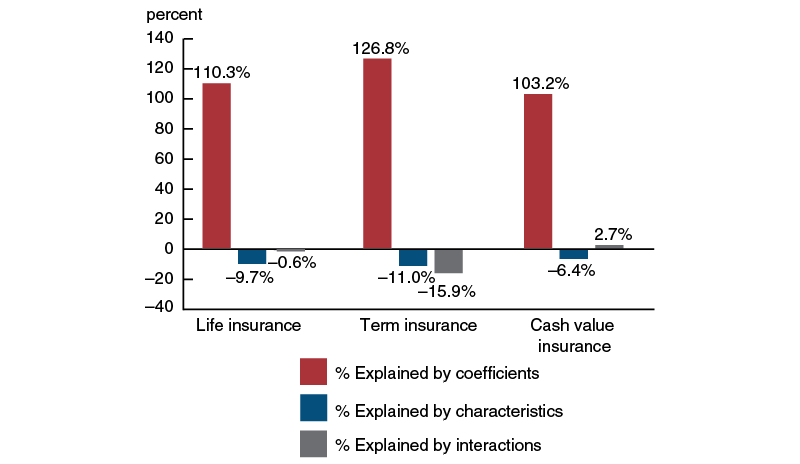

What Explains The Decline In Life Insurance Ownership Federal Reserve Bank Of Chicago

Life Insurance Loans A Risky Way To Bank On Yourself

Lic Vs Ppf Similarities Differences And Which One Is Better

/GettyImages-539244461-88be1a7f24a049229ce2956e0a60d393.jpg)

Corporate Ownership Of Life Insurance Coli Definition

Life Insurance Loans A Risky Way To Bank On Yourself

Bank Owned Life Insurance Boli

What You Must Know About Taxability Of Life Insurance Policy Payouts The Economic Times